TKay Nthebe

“The first wealth is health” Ralph Waldo Emerson

One of the biggest assets we have at our disposal is our good health, yet so many Basotho take it for granted. Examples range from bad eating habits, excessive drinking, reckless driving, poor sleeping patterns and our lacklustre attitude towards exercise. Also worrying is the misconception that medical aid or hospitalisation plans are expensive, but have you considered the cost of an Intensive Care Unit (ICU) or staying in a hospital ward for two weeks?

The question I often ask is can your finances adequately cover you should a medical emergency happen? In this article, I will discuss the importance and benefits of having medical aid.

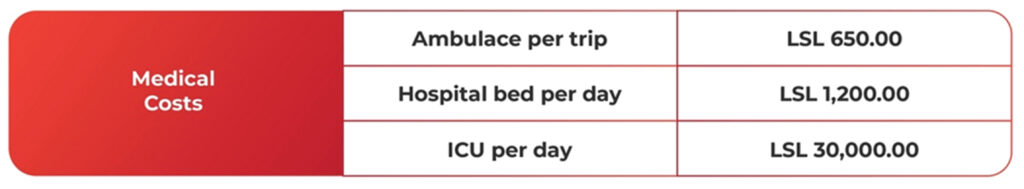

A medical aid is a plan that covers you should you be hospitalised due to medical emergencies such as critical illness in exchange for a monthly premium. The cost of good health care can quickly get out of control if you aren’t financially prepared, leaving you in financial ruin. Imagine being hospitalised for two weeks where the daily fee for a hospital ward is M1,200.00 (excluding medication and the cost of an ambulance) in a private hospital as shown in the table below. Can you comfortably afford a medical bill of LSL16,800.00?

Table 1: Average costs at a Private Hospital

This financial risk can be transferred to a medical aid provider by paying a monthly premium to minimise the financial blow should a medical emergency happen. Most medical aid providers offer plans that cater to different segments, ranging from students, low-income earners, professionals, entrepreneurs and retirees. Though people believe that medical aid is expensive, did you know that premiums range from as little as LSL1,275.00 (look at table 2 below) per month on average depending on the type of cover. Alternatively, you can also access medical services at any State Health Facility country (cost are included in the table below).

As discussed in my previous article “Create an exciting spending plan” medical aid premiums should form part of your monthly budget if your employer doesn’t deduct it from your pay slip. By so doing you will be better prepared should a medical emergency occur and avoid eroding your savings to cover medical expenses.

Medical aid plans also include other benefits such as a savings account that covers over the counter expenses such as multi-vitamins, optometry and dentistry services. An important consideration however is to fully disclose your health conditions for example diabetes, heart condition, habits such as smoking and extreme sport to ensure you are adequately covered.

It is often said that “prevention is better than cure” which is true in my opinion. I’d also take it further and quote Benjamin Franklin where he says: “If you fail to plan; you are planning to fail”. Medical emergencies happen when we least expect them, so let us plan and prepare for them. Taking care of our health and finances is our responsibility. Speak to your Medical Aid Provider or broker to ensure your health planning is taken care of. Likhomo!

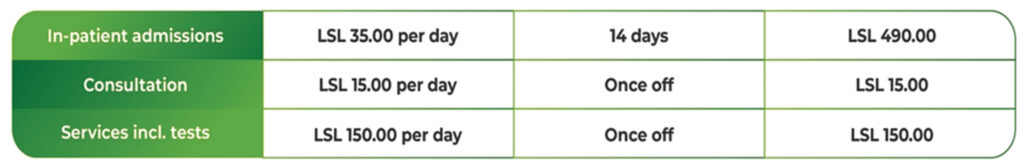

Table 1.2: Average cost at State Hospital

Table 2: Average costs for the main member (from Local Medical Aid Providers)

Source: Average premiums from Local Medical Aid Providers